Overview: Cryptocurrencies can buy goods and services, play games, and trade for profit. If you are considering investing in crypto in 2023, you’ve come to the right place. Learn more about Cryptocurrency and its functionality here.

At some point, many of us have considered investing in crypto. Crypto investing is a vast field; there is much more to it than meets the eye. Cryptocurrency has revolutionized the financial landscape since its inception, and in 2023, it continues to shape how we perceive and interact with money. This digital form of currency has brought about numerous advancements and debates, impacting the financial industry and various sectors of the global economy.

We have already witnessed the era of ChatGPT and the all-new FedNow instant payment service. So here we are TechnBrains has this fresh guide to what Cryptocurrency is. Read on to learn all about Cryptocurrency for beginners.

What is Cryptocurrency?

Cryptocurrency, also referred to as “crypto,” is a digital form of currency that can be used for payments and investments. The term “crypto” is derived from the use of encryption techniques that ensure secure transactions without the need for a centralized authority like a bank or government.

Bitcoin, one of the most well-known examples of cryptocurrency, was designed to offer a decentralized payment option that operates independently of traditional financial institutions. This means that individuals can use Cryptocurrency to make transactions without the need for intermediaries such as banks or payment processors. Overall, Cryptocurrency represents a new and innovative way to conduct financial transactions in a more secure, transparent, and efficient manner. Bitcoin was primarily developed as a decentralized payment system free from central bank control or distribution.

Types of Cryptocurrencies

Bitcoin is only a type of Cryptocurrency. Before investing in Cryptocurrency, you need to know the types of Cryptocurrencies. They are below:

Bitcoin (BTC):

Bitcoin is the first and most well-known Cryptocurrency, often referred to as digital gold. It laid the foundation for the entire cryptocurrency ecosystem and is primarily used as a store of value and a medium of exchange.

Ethereum (ETH):

Ethereum introduced the concept of smart contracts and decentralized applications (DApps). It’s not only a cryptocurrency but also a platform for developers to build and deploy various applications on its blockchain.

Non-Fungible Tokens (NFTs):

They represent unique digital assets or artwork, unlike fiat and cryptocurrencies, which are interchangeable.

Ripple (XRP):

Ripple aims to revolutionize cross-border payments and remittances. It focuses on facilitating fast and cost-effective international transactions, making it popular among financial institutions.

Litecoin (LTC):

Created as a “silver to Bitcoin’s gold,” Litecoin is a peer-to-peer cryptocurrency that offers faster transaction confirmation times and a different hashing algorithm.

Cardano (ADA):

Cardano is known for its focus on research-driven development and peer-reviewed academic research. It aims to create a more secure and scalable blockchain platform.

Polkadot (DOT):

Polkadot is a multi-chain blockchain platform that enables different blockchains to interoperate and share information, fostering a more interconnected blockchain ecosystem.

Binance Coin (BNB):

Initially, the creators designed Binance Coin as a utility token for the Binance exchange, but it has since grown to offer various use cases, such as trading fee discounts and participation in token sales on the Binance Launchpad.

Stellar (XLM):

Stellar aims to facilitate cross-border payments and financial inclusion by connecting banks, payment systems, and individuals. It focuses on providing fast and low-cost transactions.

Chainlink (LINK):

Chainlink is a decentralized oracle network that aims to connect real-world data with smart contracts on the blockchain. It’s crucial for enabling smart contracts to interact with external data sources.

Dogecoin (DOGE):

Initially created as a joke, Dogecoin has gained a following due to its vibrant community and philanthropic efforts. It’s often used for tipping and charitable donations.

Solana (SOL):

Solana is known for its high-speed blockchain platform, capable of processing thousands of transactions per second. It aims to support decentralized applications and crypto projects.

Filecoin (FIL):

Filecoin is focused on decentralized storage solutions, allowing users to rent out their unused storage space in exchange for cryptocurrency rewards.

Uniswap (UNI):

Uniswap is a decentralized exchange (DEX) built on Ethereum. It allows users to trade various ERC-20 tokens directly from their wallets without the need for a centralized intermediary.

Tether (USDT):

Tether is a stablecoin pegged to the value of traditional fiat currencies, such as the US Dollar. It provides stability in the volatile cryptocurrency market.

These are just a few examples of the many cryptocurrencies available today. Each Cryptocurrency serves a unique purpose, whether it’s offering fast transactions, enabling smart contracts, enhancing cross-border payments, or providing a store of value. As the cryptocurrency ecosystem continues to evolve, new types of cryptocurrencies with innovative features and use cases are likely to emerge.

The Evolution of Cryptocurrency

Cryptocurrency’s story began in the late 2000s with Bitcoin’s creation by Satoshi Nakamoto. Bitcoin’s innovative whitepaper introduced the concept of decentralized digital currency and blockchain technology. Early days were marked by curiosity, with a small community experimenting with mining and trading.

Bitcoin’s success inspired the creation of alternative cryptocurrencies like Litecoin, which aimed to address limitations. Ethereum’s introduction in 2015 brought “smart contracts” and decentralized applications, expanding possibilities. The ecosystem’s growth raised regulatory and security concerns, along with debates about its future. Cryptocurrency’s journey continues, impacting finance and technology through innovation, regulatory shifts, and evolving public perception.

Why do people invest in cryptocurrencies?

People invest in cryptocurrencies hoping for a rise in value, which leads to profit. For instance, increased demand for Bitcoin can raise its value. If Bitcoin gains popularity as a payment method, its value in USD could go up, providing an opportunity to make money by selling it.

Ethereum is a blockchain network where developers create financial apps without relying on third-party financial institutions. Ether is the Cryptocurrency used for building and running applications on Ethereum. The more apps built on Ethereum, the higher the demand for Ether. Some people don’t consider cryptocurrencies as investments. Bitcoin enthusiasts believe it’s an improved monetary system and prefer its use as everyday payment.

How does Cryptocurrency work?

Cryptocurrencies use blockchain technology to prevent double-spending and maintain a tamper-resistant record of transactions. Depending on their use, cryptocurrencies can be referred to as coins or tokens. Some function as units of exchange, while others store value or allow participation in software programs such as games and financial products.

How do NFTs and Cryptocurrency work together?

Non-fungible tokens (NFTs) and Cryptocurrency are both part of the proposed Web3 and the metaverse. Unlike Cryptocurrency, users cannot exchange NFTs for one another, but they can engage with both. To purchase NFTs, users need a crypto wallet, which is also where they store NFT keys as proof of ownership.

Users keep their crypto wallets secure, similar to an offline wallet. Although many NFTs can only be purchased with Cryptocurrency, there are often options to buy with local currency or credit cards. Users may advertise crypto and NFT investments or sales on social media, potentially reaching children and teenagers. If you want to get started on NFT development, let’s start here.

How are cryptocurrencies created?

One of the most common ways to create cryptocurrencies is through mining, a process used by Bitcoin. This can be an energy-intensive process where computers solve complex puzzles to verify transaction authenticity on the network. In return, owners of these computers can receive newly created cryptocurrencies.

Other cryptocurrencies use different methods to create and distribute tokens, many of which have a lighter environmental impact. For most people, buying Cryptocurrency from an exchange or another user is the easiest way to obtain it.

Pros and Cons of Crypto

It is a double-edged sword. It offers exciting opportunities for financial empowerment, innovation, and inclusion, but it also comes with significant risks and uncertainties. As the crypto landscape continues to evolve, individuals must weigh these pros and cons carefully before diving into the world of digital finance.

| Pros of Cryptocurrency |

Cons of Cryptocurrency |

| Decentralization |

Volatility |

| Security |

Lack of Regulation |

| Accessibility |

Security Concerns |

| Transparency |

Limited Acceptance |

| Lower Transaction Fees |

Irreversible Transactions |

| Investment Potential |

Environmental Concerns |

| Financial Inclusion |

Legal Ambiguity |

| Innovation |

Lack of Consumer Protection |

Pros of Cryptocurrency

Decentralization

One of the most significant advantages of Cryptocurrency is its decentralized nature. It’s not controlled by any central authority, like banks or governments. This empowers individuals with financial autonomy.

Security

Cryptocurrencies are built on robust cryptographic technology, making them highly secure. Transactions are irreversible, reducing the risk of fraud.

Accessibility

Cryptocurrency is accessible to anyone with an internet connection, bridging the gap for those without access to traditional banking services.

Transparency

Blockchain technology ensures transparent and publicly verifiable transactions, reducing the chances of corruption.

Lower Transaction Fees

Cryptocurrency transactions typically have lower fees compared to traditional banking systems, especially for international transfers.

Investment Potential

Many have reaped substantial profits through cryptocurrency investments as the value of certain coins has skyrocketed.

Financial Inclusion

Cryptocurrency has the potential to include the unbanked population, providing them with access to financial services.

Innovation

The blockchain technology behind cryptocurrencies has spurred innovation across various industries, from finance to healthcare.

Cons of Cryptocurrency

Volatility

The cryptocurrency market is notoriously volatile, with prices capable of wild fluctuations in a short period, posing a risk to investors.

Lack of Regulation

The absence of regulation makes cryptocurrencies susceptible to scams and fraudulent schemes.

Security Concerns

While the blockchain itself is secure, individual users can fall victim to hacking, phishing, and theft.

Limited Acceptance

Despite its growth, Cryptocurrency is not universally accepted as a form of payment, limiting its practical use.

Irreversible Transactions

The irreversible nature of cryptocurrency transactions can be problematic if you make a mistake or fall victim to fraud.

Environmental Concerns

Cryptocurrency mining consumes vast amounts of energy, raising concerns about its environmental impact.

Legal Ambiguity

Cryptocurrency’s legal status varies from country to country, leading to uncertainty and potential legal issues.

Lack of Consumer Protection

Unlike traditional banks, cryptocurrency transactions offer little to no recourse for consumers in the event of disputes.

Are NFTs cryptocurrencies?

Non-fungible tokens, commonly known as NFTs, are a type of digital asset that allows individuals to own a unique digital file. With NFT development, people are building a fortune for themselves. These assets can be exchanged in online marketplaces, similar to the way cryptocurrencies are traded. NFTs are distinct from other digital assets in that each one is singularly unique and cannot be replicated or interchanged with other tokens. As a result, NFTs are highly sought after by collectors and enthusiasts alike.

Are cryptocurrencies financial securities, like stocks?

Currently, the classification of Cryptocurrency as a security is ambiguous. In finance, security is any tradable item that represents value, such as stocks or bonds. Legal experts and industry leaders who argue that traditional securities regulations do not apply to cryptocurrencies are challenging the suggestion that regulators should regulate cryptocurrencies like securities. The Securities and Exchange Commission is paying close attention to the cryptocurrency industry, expressing concerns about activities like crypto staking. The SEC’s decision on whether or not to classify cryptocurrencies as securities could have significant implications for the future of this asset class.

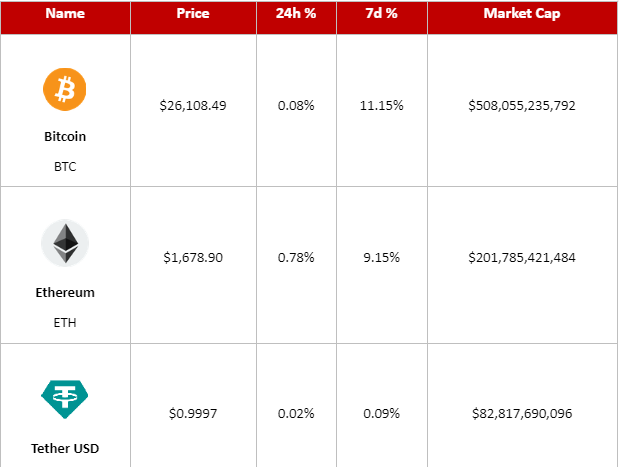

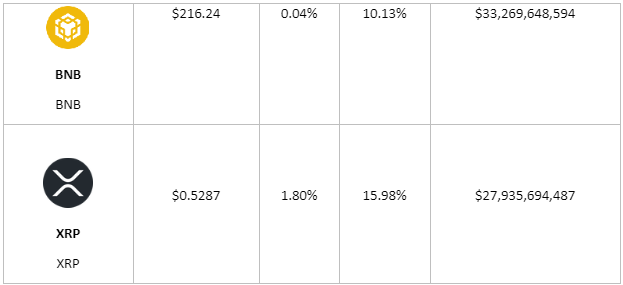

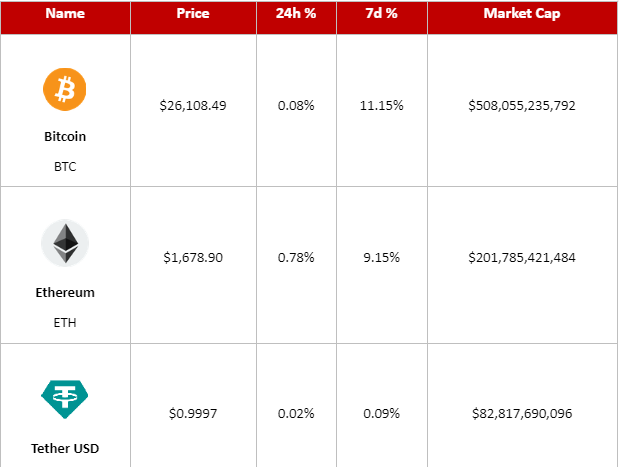

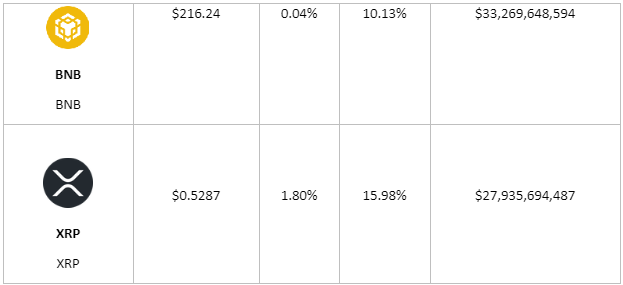

Today’s Cryptocurrency Prices

Here are today’s prices for some of the most popular cryptocurrencies (21 Aug 2023)

Crypto Future Predictions for the Next 5 Years

The crypto market’s volatility makes it difficult to predict, but there are notable trends. Bitcoin’s performance significantly impacts the broader crypto market. Increased institutional adoption and limited supply post-halving could propel Bitcoin beyond $100,000 in the next 5 years. Ethereum’s transition to Ethereum 2.0 could unlock additional value. The platform’s potential for DeFi applications and smart contracts has experts predicting a bullish future, with prices expected to surpass previous records. DeFi platforms like Uniswap, Chainlink, and Aave have experienced rapid growth. As the DeFi sector expands, these coins could enjoy further appreciation.

Why is crypto down today?

Cryptocurrency prices dipped on Thursday morning as derivatives traders began liquidating hundreds of millions of dollars in options and futures contracts. This is a common occurrence after prolonged declines in asset prices, which happened to Bitcoin and other digital currencies throughout August. The gradual price reductions eroded spot prices, resulting in a decline of over 7% for BTC in August. As a large volume of August Bitcoin options contracts expire out of the money this week, it triggers the liquidation of Bitcoin futures, intensifying the downward pressure on prices.

Wrapping it Up

Cryptocurrency is a high-risk investment and should only make up a small part of your portfolio. It’s important to prioritize securing your retirement savings, paying off debt, and investing in less-volatile funds made up of stocks and bonds.

Diversifying one’s cryptocurrency portfolio can prove to be a smart investment strategy. Given that different crypto assets tend to fluctuate in distinct ways, spreading one’s investments across a range of cryptocurrencies can serve as a hedge against potential losses.

Researching before investing is crucial, especially in cryptocurrencies since they are tied to a specific technology, unlike stocks, which are linked to companies with well-defined financial reporting requirements. Cryptocurrencies are less regulated in the US, making it difficult to determine viable projects. Consult a cryptocurrency-savvy financial advisor for input.

For beginners investing in crypto, it may be helpful to assess the level of adoption of a cryptocurrency. Reliable crypto projects usually provide public metrics that show the number of transactions carried out on their platforms. If the usage of a cryptocurrency is increasing, it may indicate that it is gaining a foothold in the market. As the world continues to adapt to this digital evolution, staying informed about its developments is important.

FAQs

1. Is Cryptocurrency a safe investment?

It can be a lucrative investment, but it comes with risks due to its volatility. It’s essential to research and understand the market before investing.

2. Can I use Cryptocurrency for everyday purchases?

While some businesses accept it, it’s not yet widely used for everyday transactions, and this limits its practicality as a currency.

3. How can I secure my holdings?

To secure your cryptocurrencies, use reputable wallets, enable two-factor authentication, and be cautious of phishing attempts.

4. Are cryptocurrencies legal everywhere?

The legality of cryptocurrencies varies by country. It’s crucial to check your local regulations before buying or using them.

5. What’s the environmental impact of Cryptocurrency?

Cryptocurrency mining consumes a significant amount of energy, which has raised concerns about its environmental footprint. Some cryptocurrencies are exploring more energy-efficient solutions.

6. Popular Cryptocurrencies in 2023

While Bitcoin remains the most well-known currency, various other cryptocurrencies have emerged, each with distinct features and purposes. In 2023, some of the prominent ones include Ethereum, Ripple, Litecoin, and Cardano.